Our Story

Service is our hallmark of excellence.

Our solid reputation is based on years of understanding our customer… You.

Our Company

We have been providing financial services throughout the United States since 1987. Our customer satisfaction and high approval ratio has earned us the reputation as a leader in the finance and leasing industry. Engaging in a broad spectrum of equipment financing and business loan services, each transaction is structured to offer the most cost-effective method to acquire new equipment, expand business and/or consolidate debt.

We are successful when you are. Our efforts are concentrated in growing strong relationships through an extraordinary emphasis on customer service – both for our customers and for the equipment vendors that supply them.

Financing and leasing play essential roles in providing capital that make industries more productive and profitable. We are proud to be a vital part of this industry. With our portfolio funds and lines of capital, we can match customers’ financial needs and increase sales volume. We’re not a super bank, we’re much better. We are small enough to offer personalized service, yet large enough to provide financial strength and stability. Our solid reputation is based on years of understanding our customer…You.

“An investment in knowledge pays the best interest.”

– Benjamin Franklin

Locations

Central Florida includes our offices in Tampa and Orlando

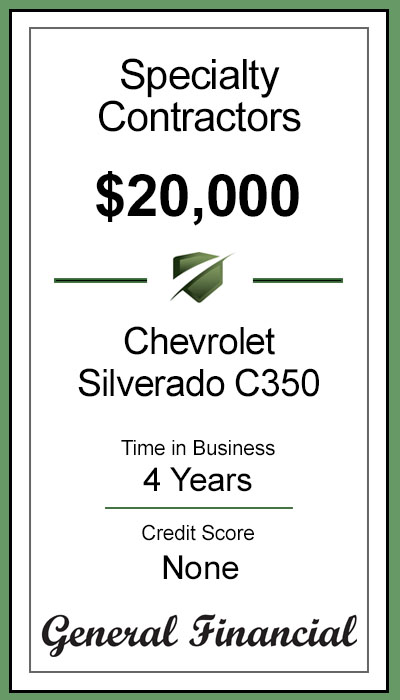

recent transactions

our commitment to you

We have been originating commercial equipment loans and leases for decades. We have loyal, deep rooted relationships with thousands of our customers, from hard asset construction equipment to software, shipping and installation costs. We leverage our expertise to educate our customers and guide them in making the right choices for today and tomorrow. We treat our customers like we want to be treated, with honesty, integrity, and respect. We want you to be our customers for life.

Honest

We Believer in the Golden Rule: This is how we run our business. We’ve been giving honest, straight forward answers, for over 35 years, Yes - even if it’s not what you want to hear. “Do unto others as you would have them do unto you.”

Transparent

Navigating lease or loan documentation can be complex. Allow us to streamline this for you with our electronic documents and our industry knowledge. Relax with a complete understanding of what it means before you sign on the dotted line.

Comprehension

Attentive to details; your business is our passion. If you don’t comprehend, we will not assume. As we work together, it’s our goal to earn your business and your trust. If you don’t come back a 2nd time, then we don’t deserve it.

Open Communication

Our business hours are your business hours. We genuinely enjoy picking up each phone call to hear from you. We encourage discussion that leads to deeper understanding. We're here for you, drop us a line or give us a ring.

Expert Advice

We have over three decades of improvements to add to your experience and our process. We are just getting started. Our representatives aren't just textbook educated, they're field educated as well.

Quality

It’s always something we strive for and happy to help you. We treat our customers like we want to be treated, with honesty, integrity, and respect.